Ravi Jaipuria-owned Devyani International has inked a 60:40 JV with GMR to set up multiple food retail outlets at the Delhi International Airport. The details of the JV are still being worked out.

The 250 crore rupees DIL, which is the Indian franchisee of global food retail chains Pizza Hut, KFC and coffee chain Costa Coffee, is also venturing into the restaurant retail chain space under its own brands.

It is setting up a nationwide chain of restaurants under three different brands — Southern Spirit, Curry Republic and Oriental Cuisine. Raj Gandhi-RJ Corp president, group CFO said, “The portfolio expansion from serving international cuisine to local food is aimed at broad-basing our business”.

Apart from food retail, the two thousand crore rupees’ RJ Corp, which is also PepsiCo’s biggest bottler, has business interests in Walt Disney group company Disney Artist, liquor, real estate, hotels and education.

Monthly Archives: September 2009

RJ Corp – GMR JV

Omaxe may raise prices

Real estate developer Omaxe Ltd may raise prices this financial year and plans to launch four new projects over the next two months on rising demand, its chairman said.

Mr. Rohtas Goel said, “Demand might be robust. I will increase prices very soon, in single digits within this year”.

The firm will invest fifteen billion rupees on the new projects, Goel said, adding he expects revenues of 23 billion rupees from the projects over 30 months.

India’s property market is recovering from a bottom hit earlier this year, and analysts say much of the demand will be from middle-income and affordable housing.

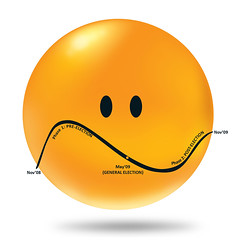

Real Estate Looking Forward

The reactions to real estate market are mixed. The looking up of this market in the US economy has raised some hopes in the Indian markets too. Various real estate companies have expressed that the market is looking up, and is likely to improve in the coming days, but some companies are skeptical and want to see actual results flowing in before commenting.

There has been some increased activity on the real estate market front in the recent weeks and this has raised some hopes. The media also reported that the prices of houses would not drop down further indicating that there is stability in the market.

The following weeks would be crucial and they could decide which way the market would go in the coming weeks.

Vijaya Bank looking at business from NRI accounts

Vijaya Bank has prepared a blueprint for taking its business from NRI accounts to five thousand crore rupees by 2011.

At present, NRI accounts contribute almost thirteen hundred crore rupees to its consolidated business volume.

Vijaya Bank Chairman and MD Albert Tauro said, “We are working on ‘Mission NRI 5000’ to grow to five thousand crore rupees in the segment by financial next year”.

Further he added, “We plan to grow both in terms of clients and volume in this segment, especially in Kerala, Karnataka and Andhra Pradesh, but it would need some seeding time”.

Besides, the bank has taken lead in financial inclusion and branch-less banking by opening almost a million no-frill accounts.

He added, “We will soon launch mobile banking facility and up our number of branches and ATMs to 1200 and 500, respectively, across India”.

He pointed, “Our CASA stands at 24% and we are targeting CASA level of 28% by the end of current financial year”.

Tauro informed, “The bank has successfully brought down its cost of deposit and raised yield on deposit. This has improved our net interest margin from 1.68% to 2.38%”.

The bank had so far restructured and rescheduled Rs 2,400 crore worth of loans, especially to the MSME, housing and real estate sectors.

The CMD was in town to inaugurate ten new branches in Lucknow region. The branches were opened in Lucknow, Badaun, Fatehpur, Hardoi, Pilibhit, Sultanpur and Hathras districts.

Developers show anger for new bill

A draft bill on real estate regulator that will protect the interest of home buyers by ensuring a transparent and healthy real estate sector has drawn the anger of developers.

According to Mr. Kumar Gera, Chief-CREDAI, “The government is trying to play nanny to the home purchaser”.

According to the new bill, a builder will have to register a project with the regulator before he does marketting for the properties. For this, the builder will have to submit a documentary proof of land ownership and the mandatory licenses for registration.

After verification only, the entire information about the project will be available on the regulator’s Website that will be accessible to common people. The regulator will also scrutinize the advertisements and names of brokers.

This process will make certain the legitimacy and the viability of the project, ending the current practice of realty firms launching projects without land ownership or mandatory approvals that leads to buyers getting stuck with fake projects.

Gayatri Projects to pay 40 percent divident

Janpath, Samrat hotels to get posh makeover

After revamping its flagship hotel, The Ashok, ITDC is going full-steam ahead to give hotels Janpath and Samrat a makeover designed to make the competition sit up and take notice.

As part of the renovation, Hotel Janpath will soon boast of onyx pillars and a mini-spa in each room on four floors. The spas will be equipped with a jacuzzi, massage table and medicine dispenser while one spa each on the ground floor and first floor will offer services of a gym, sauna, steam room and treatment room. For those working on their tan, the rooftop will have a solarium.

“The personal spa concept is likely to require an investment of Rs 45 crore. We are still in the process of finalizing the details,” a senior ITDC official said.

The hotel has already seen some tangible changes like a cobbled stone driveway. The grim, white-washed facade has been knocked down in favour of glass and the decrepit restaurants, known only for political sit-downs, have been opened to private players. While designer Rohit Bal promoted Italian joint Cibo opened earlier this year, Mismo and Swagath are the other top of the line eating places that the hotel hosts.

Foreign investment in agriculture

Despite natural benefits, agriculture continues to languish for need of adequate investment and policy support. The case for reviving agriculture to meet the rising food needs of countries having huge population. The global food price crisis of last year highlighted the requirement to boost farm production and productivity through higher investment. The need to broden FDI flows in the agricultural sector has been gaining importance from last year. Recent Unctad World Investment Report has made out a cautious case for entry of transnational corporations with FDI. The report states that the stimulus is crucial for increasing productive capacity and farm output in the poorer countries. These investment inflows fall far short of their potential, the agency suggests developing a set of internationally agreed core principles for large-scale acquisition of agricultural land by foreign investors.

There is consensus among experts that one of the lingering effects of the price crisis on the world food system is the rapid and widespread acquisition of farmland in developing countries by other countries seeking to ensure their food supplies. While such acquisitions may insert required investment into rural areas in low-growth agrarian economies, they also raise concerns about the impact on the local resident, who risk losing access over land on which their livelihoods depend. It is difficult to ensure that these land deals are designed in a manner that will secure the living of local resident.

Commodity Mutual Funds lift the sensex

MFs that deals with commodity and energy stocks have beaten the Sensex returns as well as the 70% category average returns of diversified equity funds on a year-to-date basis ending 18 September of this year, credit goes to dual benefit of the rally witnessed in the equity markets and commodity rally as well.

5-8 funds that invest in mentioned theme outperformed the Sensex. Funds such as Mirae Asset Global Commodity Stocks Fund, DSP BR Natural Resources and New Energy Fund comfortably outpaced the Sensex by 6%to return about 80% during the mentioned period. The funds had a mix of overseas and domestic stocks in their portfolios.

Exposure to global mining, metal and oil refining stocks were the key drivers for the rally in these funds.

While the former held higher exposure to overseas stocks, the later managed an equally good performance, although overweight on Indian stocks.

Lancor MD picks up more stake

Lancor Holdings’ MD, Mr R.V. Shekar, has informed the stock exchanges that he is acquiring up to 5% of the equity shares in the company at current market price. According to the information, Mr Shekar has acquired 1.23 lakh shares representing 0.61% stake for a total value of Rs 1.08 crore last week. This translates to a price of Rs 87.95 a share. Following the acquisition, his stake in Lancor stands at 27.87%. The Chennai-based real estate developers’ shares closed at Rs 89.25, about 5% higher than the previous close of Rs 85.05.

Impact of new order on premium FSI

The Government order permitting premium FSI in the area coming under Chennai Corporation, 16 municipalities, 20 town panchayats and 214 village panchayats in Chennai, Tiruvallur and Kancheepuram districts is expected to have a marginal impact on end users.

The gazette notification is expected shortly and the move would permit builders of new projects in CMA, excluding the Red Hills catchment area and areas adjoining water bodies maintained by the Chennai Metropolitan Water Supply and Sewerage Board for drinking water purpose, to construct extra floor space on payment of a premium.

“It is too early to forecast the impact of permitting premium FSI on prices of housing units in Chennai,” said Vikram Kapur, member secretary, CMDA.

There could be a marginal reduction in cost of housing units in new residential projects if the market value is higher than the guideline value, said R.Kumar, MD of Navin.

But buyers of the residential projects making use of the provisions of premium FSI would have lesser undivided share of land when compared to the projects which did not seek premium FSI, he added. The premium paid does not bring anything tangible.

ADB raises growth forecast for India

Owing to increased public spending and improved business confidence, the Asian Development Bank (ADB) has hiked its growth forecast for India from 5% to 6% this fiscal.

The update to ADB’s Asian Development Outlook (ADO) 2009 report released Tuesday said that India will grow at 7% in 2010, a revision from its earlier forecast of 6.5%.

“Normal rainfall in fiscal 2010, a pick-up in exports (as the recession ends in industrial economies), and strengthened investor confidence is now projected to lift GDP growth to 7% in fiscal 2010”.

“GDP growth in the second and third quarters is expected to fall below the 6.1% first-quarter expansion because of weak agriculture, but to recover sufficiently in the fourth to post a 6% annual expansion.”

According to ADB, “an increase in public spending, a quicker than expected return of capital inflows, stronger industrial production, and signs of improved business confidence will lift economic growth to 6 percent in India this year, up from an earlier estimate of 5%”.

Punjab and Sind Bank, Hudco tie up

Punjab and Sind Bank has announced that it has entered into an MoU with Hudco under the scheme of Interest Subsidy for Housing the Urban Poor. Loan amounts from Rs 1 lakh to Rs 1.60 lakh will be made available by the bank. A subsidised rate of interest of 5% will be charged for the full period of the loan, subject to a maximum loan amount of Rs 1 lakh. The bank has already reduced its lending rates for the home loans t o provide impetus to the housing industry. These rates will be effective from today and will remain till year-end.

Keep on investing

Socially responsible investments (SRI) are often hailed as a means to finally effect meaningful change on the environmental landscape. The rationale is that ethical screens on an investment universe should nudge corporate towards sustainable policies and actions as capital is channeled towards those that demonstrate an orientation towards environmental, social and governance factors.

Until the last decade, this class of investments was regarded as a niche and often marginal segment. But as larger pension funds begin to include ESG factors in their investment framework, sustainable investing may finally be moving mainstream.

Retail investors begin to return

Retail investors are regaining confidence in the primary market but they seem to be gradually making their presence felt in the secondary market.

Leading retail brokers say that they are seeing an increment in the number of clients returning to the market. The only difference is that investors are taking small bets, and quickly booking profits even if they are not large.

Growing retail investor interest can also be gauged from the fact that indices tracking the SME space have outperformed the key indices in the run-up to five thousand level touched by Nifty during intra-day trading.

Raymond to enter realty

Textile company Raymond plans to move towards realty sector. The initial project would be to develop the surplus land of 15-20 acres in Thane, where its factory is located. Mr Gautam Singhania, Chairman and Managing Director, Raymond, said in a press conference that the primary focus would be in the residential segment and funding would be from internal accruals. He further said, “This proposal is in line with the strategy of the company to unlock value of the land.” Further he added that it was subject to shareholders’ approval.

India’s FDI increases

India’s FDI inflows reached to 41.5 billion dollars last year, constituting 9.6% of its gross fixed capital formation, against just 1.9% annual average in 90s.

India attracted 41.5 billion dollars in FDI last year, its outward flows or overseas investments amounted to 17.7 billion dollars, roughly 4.1% of its gross fixed capital formation. This is in sharp contrast to its meager annual average overseas investments of 110 million dollars for last decade, when such outward investments comprised 0.1% of its gross capital formation.

The FDI stocks of India, which were just 1.6 billion dollars in 1990, zoomed to 123.3 billion dollar in 2008, constituting 9.9% of GDP, against a paltry 0.5% of GDP in 1990. In the case of China, such FDI flows, which were 20.7 billion dollars in 1990, leapt to a whopping 378 billion dollars last year.

In the case of cross-border mergers and acquisitions, Indian companies’ net sales surged from an annual average of 282 million dollars during 90s to 4.4 billion dollars in 2007 and to 9.5 billion dollars in 2008. Against this, Indian companies’ purchases of overseas firms which averaged 104 million dollars annually between 90s rose to a peak of 29 billion dollars in 2007 and came down to 11.6 billion dollars last year in the wake of the onset of the global economic and financial crisis.

Two Indian companies, Tata Steel and ONGC, found a place among the top hundred non-financial transnational companies from developing countries, ranked by foreign assets in 2007.

BDA plans projects for slum dwellers

With a view to offer decent living conditions to the slum dwellers in the city at reasonable rates, Bhubaneswar Development Authority plans to develop housing projects for them.

BDA will develop housing projects for these people belonging to the economically weaker sections in 5-6 locations in and around the city. BDA would offer single bedroom flats, with a built-up area ranging from 350-500 square feet to these people at a cost of Rs 2.5-3 lakh.

DK Singh, vice-chairman, BDA said, “As a part of our endeavor to provide basic services for the urban poor, we are planning housing projects for the economically weaker sections. The first such project consisting of 192 units is being developed near the Chandrasekharpur area of the city and we have already invited tenders for the same”.

The other locations for the housing projects are yet to be finalized. The state government would provide land for these projects at subsidized rates.

The government is also going to introduce a Slum Improvement Program for the benefit of the slum dwellers, informed Singh.

Lesson of Affordability

Previous to the great economic doom caught up with the economy and the real estate sector, life for developers was relatively cushy. High-priced houses were being hawked. But when tomorrow did come, there were many lessons to be learnt. The foremost among them is, a residential project should appeal and target the majority to be successfully sold out. Real estate developers learnt this concept of ‘affordability’ only after a large number of their premium and luxurious residential projects failed and many others had to be tweaked in order to cater to a wide spectrum of end-users.

Over the last one year, developers have announced residential projects in the affordable category. Such affordable projects of NCR reported quick sales within days of their official announcement.

Ansal to Invest 20 Billion Rupees on Townships

Ansal Properties and Infrastructure Ltd will invest twenty billion rupees in the this fiscal year as it seeks to capitalize on the demand for low-cost housing in India.

The investment will be the last installment of a total of sixty billion rupees earmarked last year by the company as the main investment to develop nineteen integrated townships over five to seven years. Ansal Properties spent forty billion rupees of the total in the last fiscal year.

Higher borrowing rates and property prices and fear of job losses in a slowing economy had hurt the demand for real estate in India last year. But, a series of stimulus packages and a reduction in loan rates by commercial banks are leading to a gradual recovery in demand this year.

FIIs fear higher tax outgo

Foreign institutional investors have approached the finance ministry looking for an extension of the ‘feedback window’ on the new direct tax code. People familiar with the issue said that the deadline for submitting feedback has lapsed. Terming the ‘window’ insufficient for a detailed response, FIIs have asked for an extension.

There is a perception that if implemented, the direct tax code could increase tax liabilities of foreign portfolio managers significantly. So far in 2009, FIIs have pumped in $8.6 billion into Indian equities.

LIC Housing Finance raising up to $136 mn

Indian mortgage lender LIC Housing Finance is raising up to $136 million through a share sale to institutional investors at a discount of 1.9% to 3.4% to its Tuesday closing price.

The company was selling 10 million shares in a QIP offering at 650 to 660 rupees each in a deal handled by Citigroup, Enam Securities, Kotak Securities, and Nomura.

LIC Housing shares rose 1.92% on Tuesday to close at 673 rupees.

Maytas Properties likely to get liquidity

The Government-appointed Director and the promoters of

Maytas Properties are near to brokering a deal that will help the unlisted entity address the main problem of liquidity to complete projects.

This infusion of liquidity could be through bringing in another developer into the company as an investor by leveraging the large land bank created over the years.

The Government-appointed Director, Mr Ved Jain, said, “We are at an advanced stage of negotiations with various lending institutions and real estate players and could potentially manage to bring in a developer as a strategic partner.”

DLF flats to cost more

DLF plans to formally launch nineteen hundred apartments in its Capital Greens project in Delhi in one week. The flats will be sold for around thirty percent more than the phase-1 price of the same project signaling the company’s rising confidence in the revival of the property market.

DLF intends to launch the second phase of Capital Greens project, two acre project located in West Delhi, at a minimum rate of Rs 6,500 a square feet, making the cheapest apartment in the project cost around Rs 80 lakh. This is significantly higher than the rate of Rs 5,000 per square feet, or the least price of Rs 60 lakh for an apartment, at which DLF sold 1,350 apartments in the first phase of the project in April.

Unlike in the first phase, when only 2 and 3 bedroom apartments were available, the second phase will have 2, 3 and 4 bedroom apartments with areas ranging from 1,200 square feet to 2,600 square feet.

Fifteen realty firms waiting to enter market

Fifteen real estate companies are waiting in the wings to tap the capital market to raise upto 6 billion dollars with the housing sector showing signs of recovery. This list includes Lodha Developers, Oberoi Constructions, Emmar MGF and Godrej Properties and many more.

These firms wanted to come out with the IPO earlier, but held them back due to bearish market. The success of a real estate IPO would depend upon corporate governance, background of the companies and the right pricing among others. Start-ups and relatively unknown firms would face difficulty to raise funds from the market.

Almost USD six billion private equity fund was also likely to come in the six to eight months time to the domestic real estate bazaar.